NEWS IN BRIEF…

19th April 2020

Last modified on May 20th, 2021

– Two more US resorts join Ikon Pass

– Ice avalanches on Mars

– More high speeds trains for Beijing 2022

– Ski racing podcast

Government coronavirus advice

It is mainly news as we concentrate on things away from coronavirus. But it also includes anything quirky that simply takes our fancy. Read on for more.

WEDNESDAY 29TH APRIL

TWO MORE US RESORTS JOIN IKON PASS

Mt Bachelor in Oregon and Windham Mountain in New York have joined the group.

This brings the total number of ski areas on the pass to 43.

Ikon Pass holders will have seven days at each ski area without blackout dates. Base Pass holders will have five days at each with some blackout dates.

Ikon said it would increase its renewal discounts for net season after the current ski season was cut short by the coronavirus.

Here on PlanetSKI we report on that development in our separate article:

Ikon Pass

TUESDAY 28TH APRIL

ICE AVALANCHES ON MARS

Catastrophic ice avalanches may have blasted down kilometers of polar ice craters of Mars at speeds of up to 80 meters per second.

According to new research the massive ice avalanches might solve a mystery about strange features on the Red Planet.

Some scientists believe water ice avalanches may be responsible for creating moraine-like ridges in two craters.

The fast moving, destructive forces may have pushed debris to their edges as they tumbled down the slopes of these craters.

Read more here.

In the past we have reported on the snow on mars

And the prospects of skiing on the planet, Kepler 22b, and one of Saturn’s moons:

SATURDAY 25th APRIL

MORE TRAINS FOR BEIJING 2022

More trains will run on the high-speed railway line connecting Beijing and Zhangjiakou.

Biathlon, cross-country skiing, ski jumping, Nordic combined and freestyle skiing and snowboarding events will all take place in Zhangjiakou.

Trains can reach speeds of 350kmh.

The line went into operation in December 2019 and it has reduces travel time between Beijing and Zhangjiakou to just 47 minutes.

The 174-kilometre journey took more than three hours previously.

There are now plans to run 44 trains during the week, with an additional seven running on weekends.

The line runs through the Yanqing District district which will be hosting the luge, bobsleigh, skeleton and Alpine skiing events.

Preparatiosn for the Winter Olympics are now back on track after being disrupted by the coronavirus pandemic as we reporter in this earlier story:

Coronavirus impact on Beijing 2022 Winter Olympics

THURSDAY 23RD APRIL

SKI RACING PODCAST

With the winter season cut short, the team managed to get together at The Hemel Snow Centre, before the lockdown to discuss an epic season of World Cup racing.

In Part 1 of 3 Ed Drake, plus Ben and Luke focused in on the individual discipline globe winner and how Covid-19 may have given them a helping hand.

Marcel Hirscher left some pretty big boots to fill, did any of the 2020 athletes really put their hand up to become the man to beat?

On the ladies side all the pre season talk was around Shiffrin and Vlhova, but it was Brignone who emerged victorious, showed a remarkable level of consistency in multiple disciplines but was it right place, right time?

“A huge thank you to Explore Impossible for coming and shooting this for us,” said Ed Drake.

It is available as a podcast on Apple and Android, just search for ‘The Ski Racing Podcast’ wherever you get your podcasts.

WEDNESDAY 22ND APRIL

NEW GONDOLA LIFT FOR CORTINA

It will link Tofane to Cinque Torri in time for the planned 2021 World Championships in the Italian resort.

Work on the connecting lift is due to start in June.

The 4.5 km long journey, in 10-person cabins, aims to link the Tofane slopes close to the town, from Son dei Prade, with the runs of Cinque Torri at Bai de Dones.

It in turn provides access to the Sella Ronda ski domain.

The lift should reduce the road traffic between the two areas, which in turn will hopefully benefit the environment.

Leitner Ropeways is aiming to complete the project by the end of 2020 or in early January 2021.

The gondola can then play its part in Cortina 2021, the Alpine Ski World Championships, the following month if they go ahead as planned.

MONDAY 20TH APRIL

PRO GOLFER TAKES A MOUNTAIN HIKE WITH A DIFFERENCE

The Austrian golfer, Matthias Schwab, took a mountain hike in the Duisitzkarsee area of the Alps at the weekend.

The 25-year old, who was born in the ski resort of Schladming, juggled a golf ball on a right-handed iron throughout the walk and made it to the top.

“Today’s objective: Make it to the top without the ball dropping on the ground and finish in style,” the European Tour player said.

FIS ACTS TO BAN PLASTICS

The International Ski Federation, FIS, has made a commitment to reduce its use of plastics at events and in its day-to-day operations

For the 2020/2021 season all SnowKidz and World Snow Day Organiser Care Packages are part of the Big Plastic Pledge to be more eco-friendly.

- No more plastic packaging

- All shipping cartons will be made from recycled cardboard and materials can be recycled after use

- The Organiser Care Packages are one of the primary support features for SnowKidz and World Snow Day events and activities.

Hundreds of materials provided to the organisers to help dress and execute their events and activities to bring children to the snow are now going to be more eco-friendly.

See more here on The Big Plastic Pledge

SUNDAY 19TH APRIL

AVALANCHE DEATH IN USA

A backcountry skier died in Red Mountain near Silverthorne in Colorado.

A group of three were going downhill when an avalanche broke away and caught them.

One was carried 600m down the mountain.

They were on the top section of a couloir known as ‘Oh What Big Eyes You Have’ on the north side of the mountain.

The other two men were unharmed and raised the alarm.

According to local media reports they were experienced and carrying the correct safety equipment.

The body of the man has not yet been recovered as rescue teams have judged it unsafe at the moment.

UPDATE: The body of the man has now been recovered.

He has been identified as 30-year old Aaron Wiener from Denver.

The Summit County Coroner, Regan Wood, said he died from multiple blunt-force trauma injuries suffered in the slide.

LONGEST PANORAMA SKI LIFT IN THE WORLD ON COURSE TO OPEN THIS SUMMER

Zlatibor Gold Gondola Lift is in Serbia and aims to be a major tourist attracting in its own right.

It is 9km long and connects Zlatibor with the ski centre of Tornik, via Lake Ribničko.

It can carry 1,200 passengers an hour and the journey time of 25-minutes.

Mount Zlatibor is expected to become the most-visited tourist destination in Serbia and the surrounding region, with a predicted 10mm overnight stays and around 1m visitors.

The previous longest lifts was the Tianmen Shan cable car (7.4 km) in Zhangjiajie National Park in China.

FRIDAY 17TH APRIL

WINTER OLYMPIC LEGEND AIMS TO COMPETE IN SUMMER OLYMPICS

Ivica Kostelic from Croatia won four silver medals in Winter Olympic Games over the course of his career.

The alpine skier retired from ski racing three years ago.

Since then he has become a keen sailor and wants to compete in the new discipline, Mixed Offshore Sailing, at the 2024 Olympic Games in France.

The event will be held off the coast of Marseille and he and his partner are aiming for qualification.

As well as his Winter Olympic silver medals he had 26 World Cup race victories.

He also won a gold, a silver and a bronze at World Championships in alpine skiing.

THURSDAY 16TH APRIL

MT ROSE SET TO EXPAND

The resort in Tahoe USA has won approval for its 112-acre expansion plans.

A new lift will be built opposite the main resort area.

It will offer beginner and intermediate terrain.

The agreement with the US Forest Service also restricts any future commercial use on approximately 3,446 acres in the area known as Galena Land Exchange with the exception of the 112-acre Atoma and 168-acre Chutes areas.

WEDNESDAY 15th APRIL

DISASTER!

An adjudication from the Quiz Master (see below):

Hi Alex

Thanks for joining in with The Great Big Skiing Quiz this evening, and congratulations on coming in first place!

You’ve won a ski holiday to Arinsal for two people, and despite what James might say, it was your name on the answer sheet, so you’ve won it!

SUNDAY 12TH APRIL

PLANETSKI TAKES SILVER AND WINS A SKI HOLIDAY TO ANDORRA

We came second in The Great Big Skiing Quiz on Sunday night and this, combined with our second place last week, means we are the overall winners.

138 teams played over the two weeks with most playing both times.

The event was devised by Steve Hull from Destination Ski as a fun way to pass Sunday night in these days of lockdown.

Our team consisted of the PlanetSKI editor James Cove, plus his daughter Tashie and son Alex and his girlfriend, Marie.

James’ wife, Kisia, joined via Facetime from Hythe where she is looking after her Mum.

Team PlanetSKI. Image © PlanetSKI.

There were five rounds: Winter sports, Destinations, Picture round, General Knowledge and Winter Olympics.

They amassed 114 points but trailed the winners Solo Skier, by 10 points.

However as Team PlanetSKI came second last week they had the highest total number of points.

“The secret to our success was unity of purpose and team spirit,” said James.

“However that has all gone totally out of the window. We are now fighting and arguing like mad as the prize is a holiday for two and there are five of us.

“I am claiming the two people who got the most answers right should go.

“It is the simplest and fairest way to do it and it is of course pure co-incidence I am advocating this as I am the person who got the most answers right in the team.

“The others are saying I am the last one who should go to Andorra as I ski all the time anyway.

“Oh well, I guess we have plenty of time at the moment to work this one out.”

The Great Big Skiing Quiz

THURSDAY 9th APRIL

LIFT OPERATOR ‘NOT PAYING ATTENTION’ AS MAN SUFFOCATED AFTER JACKET CAUGHT ON LIFT

46-year old Jason Varnish from New Jersey died of positional asphyxia last February on at Vail Mountain’s Blue Sky Basin area, according to the local coroner.

He was with a friend and were attempting to get on the chairlift.

They were trying to lower the seat and his friend was unable to get on but Varnish’s jacket was caught and he was lifted 7m into the air as the chairlift continued.

His ski jacket was caught around his neck.

The lift operator was clearing snow at the time and took some time to reverse the lift to bring him back.

When he was brought back he was unconscious and did not respond to CPR.

His death has been ruled an accident.

Vail, Colorado

SUNDAY 5TH APRIL

PLANETSKI TAKES SILVER

The Great Big Skiing Quiz took place on Sunday evening and Team PlanetSKI came second with a score of 83, just 1 point behind the winner, Coops.

The winner took the £100 voucher kindly donated by Ellis Brigham

There were 93 points up for grabs from 46 questions and 6 picture questions.

There were 127 teams involved and about 200-250 people taking part in the online event.

It was run on Facebook by our great friend, Steve Hull from Destination SKI.

“I’ve never done anything like that before so not sure how it came across, hopefully well enough to keep people engaged as most people seemed to stick with it,” said Steve to us afterwards.

Steve, the Quizmaster. Image © PlanetSKI.

Well, we thought it was brilliant and a perfect way to pass an hour or so in this time of lockdown.

Questions included, naming where the first Winter Olympics were held, identifying which resorts certain lifts were in from pictures, general knowledge questions plus a food and drink round.

Team PlanetSKI consisted of our editor James Cove and his three children Alex, Tashie and Max who have all been ski instructors.

Alex’s girlfriend, Marie, is Canadian and with us in lockdown.

She was spot on for the ice hockey and curling questions.

And the biggest disagreement in Team PlanetSKI?

“How many ski resorts are there in Australia?”

James went for 14 without a moment’s hesitation. Alex went for 16.

“Look old man I worked in Australia for a whole season a couple of years back and you have just visited a few times on your meandering travels round the ski resorts of the world. I am in charge of writing the answers and I am writing 16,” said Alex.

Alex proved to be correct.

There is another round next Sunday at 8.15PM and we highly recommend you to join in the fun.

Best Sunday night in for ages!

The Great Big Skiing Quiz

THURSDAY 2nd APRIL

AN AWFUL LOT OF CHEESE

As if winning two World Cup Crystal Globes this season wasn’t enough for Norway’s cross-country skiing star, Therese Johaug.

The distance and overall title-holder collected a massive 42.5kg of cheese along the way.

The main sponsor of the Tour de Ski was the Swiss cheese maker Le Gruyère AOP which gave the winners of each event it sponsored 2.5kg of cheese and entered all the podium athletes into the ‘cheese challenge’.

Johaug made the podium 17 times during the sponsored World Cups.

She won the challenge and with it a four day trip for two people to La Gruyère with flights, car rental, a fondue night and a lunch at La Maison du Gruyère.

Second ranked Johannes Høsflot Klæbo (Norway) and Alexander Bolshunov (Russia) as well as third ranked Heidi Weng (Norway) each receive an original Le Gruyère fondue set including everything from stove to wine that you need to get rid of the 30kg+ amount of cheese they won during the season.

WEDNESDAY 1ST APRIL

TINA WEIRATHER ANNOUNCES HER RETIREMENT

The Liechtenstein alpine skier has announced her retirement at the age of 30.

She won a bronze medal at the Pyeongchang 2018 Winter Olympics in the Super-G.

She made her World Cup debut in 2005 at the age of 16 and won nine races on the circuit, reaching 41 podiums.

She won the Super-G crystal globes in 2017 and 2018.

Due to restrictions surrounding the coronavirus pandemic, she was unable to host a press conference to announce her retirement.

“Everything has an end (except the sausage has two??). Yep, I’ve said it. As of today, I’m officially retired and a pensioner. It was a thrilling ride, an adventure of a lifetime. Everything I am today, I am because of skiing. 15 years after my first World Cup race, I can say with no regrets that I’ve given it my all. For what and who I’m beyond grateful.

“Thank you so much.

“It’s a big step for every athlete, to decide when the right time has come – for me it’s now,” she said.

“I’ve had an amazing career”.

Here at PlanetSKI we wish her well.

NORTH EAST INDOOR SKI CENTRE GRANTED PLANNING PERMISSION

The £30m Subzero Snow Centre in Middlesbrough has received full planning permission from the County Council.

The ski facility will be built at Middlehaven Dock on a seven-acre brownfield site.

“The design of the building, which has now been approved, looks amazing and fits well into the historic site,” said a statement from Subzero.

“Subzero will make a huge contribution to the economy of the Tees Valley bringing jobs and shining a positive light on the region. We anticipate the centre will open in 2022.”

“While we rightly focus all our efforts and resources on fighting the coronavirus, this news gives us all something to look forward to,” said Tees Valley Mayor, Ben Houchen.

“The new snow centre will be massive for Middlesbrough, helping the regeneration of Middlehaven and creating jobs while giving even more people an excuse to visit, have fun and spend money in the town.”

KEY SPONSOR LOST BY NORWEGIAN SKI FEDERATION

The country’s largest civil engineering company, Veidekke, has not renewed its contract associated with cross-country skiing.

Veidekke’s investment was used largely to finance regional cross-county skiing teams.

The company also sponsored the national sprint ski team.

The news is reported by the website, Ski Nordique, that says the decision was taken at the end of 2019 for reasons not associated with the corona virus pandemic.

The Federation has recently laid off 96 employees due to event cancellations caused by Covid-19 as we reported earlier.

A member of the NSF told Ski Nordique: “Today we are going through a real economic crisis, not only the world of skiing, but everyone in the business. The future probably looks bleak, but we are not throwing in the towel.”

Norwegian Ski Federation

Now here in the snowsports world we are all finding ourselves with some time on our hands – a rare luxury.

Our great PlanetSKI friend, Amin Momen from Momentum Ski, had an idea and rolled it out last night.

RADIO SW18 – THE APERITIVO SESSIONS

“Whilst many of you have already been tortured with my music over the years, I have decided to broadcast once a week, a 30 minute Aperitivo session (my favourite time of day),” said Amin.

“It will be a blend of my best Supermarket muzak, Elevator, Department Stores as well as Soul, Funk, Disco, Rock, Bossanova, Jazz and intelligent genres such as Steely Dan, Floyd and so on…….depending on the mood of the day.”

“I assume 7pm is a good time for ice and slice?”

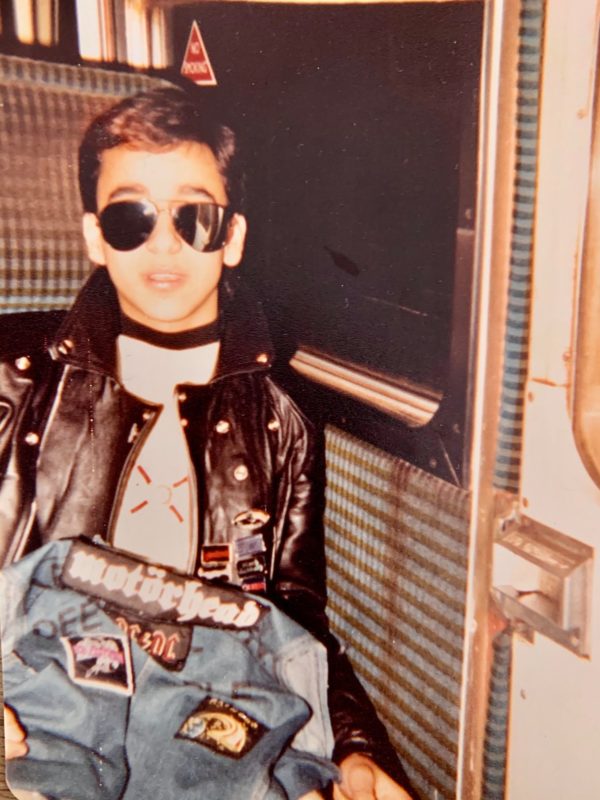

Once a rocker always a rocker

And it was. We tuned in all the way through and will be back next week.

Go Amin!

Amin in action

And staying with what some of our friends in the ski world are up to….

THE GREAT BIG SKIING QUIZ

Game on

“We’re really missing the mountains, so we’ve come up with The Great Big Skiing Quiz to test your knowledge of skiing and other winter sports, hosted by Steve from Destination Ski,” said Steve Hull from Destination Ski.

It’s on Sunday 5th April at 8pm.

Round one is sponsored by Ellis Brigham Mountain Sports and the winner receives a £100 gift voucher.

There are five categories of questions, including winter sports, a picture round, and food & drink.

Round two will be held on Sunday 12th April, and the combined winner of both rounds will win a ski holiday for two people in winter 2020-21.

IMAGES FROM GLENCOE The Scottish resort posted a series of images earlier this week of its near-perfect Scottish skiing conditions.

“I know we can’t ski at the moment but thought we could all dream about what would be our perfect Glencoe line. What would yours be??” said the resort.